Impact of the Dec. 2025 US CPI Report

A steady inflation reading gave markets a sense of relief, not enough to spark a rally, but enough to keep optimism alive.

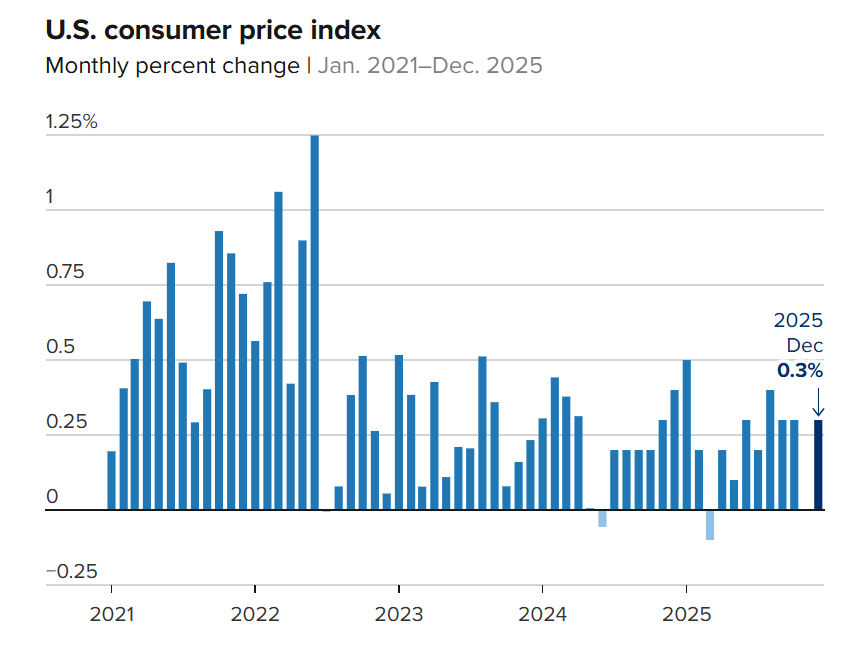

When the December CPI numbers landed, Wall Street didn’t gasp and that in itself was the story. Inflation came in exactly as expected, with prices up 2.7% over the past year and core inflation easing slightly. For investors who’ve spent the last few years bracing for unpleasant surprises, this kind of predictability feels almost comforting. It suggests the economy is not overheating, but it also is not stalling, a balance markets tend to appreciate.

From a market perspective, this kind of inflation report is quietly supportive. Stocks generally prefer certainty, and the data reinforced the idea that the Federal Reserve does not need to rush into drastic moves. The yield on the 10-year US Treasury dipped to about 4.16–4.17% after the CPI data. At the same time, the **2-year Treasury yield drifted lower toward roughly 3.53%, reflecting expectations that short-term rates may not rise further if inflation continues to moderate. This subtle drop in yields softened borrowing costs across markets and helped calm rate-sensitive sectors.

However, there is the other side of the coin. Inflation may be cooling, but it is still above the Fed’s comfort zone, especially in everyday pain points like housing and food. That means rate cuts, the rocket fuel markets love, are probably not around the corner yet. Growth stocks, real estate, and other rate-sensitive areas may feel some restraint as borrowing costs remain elevated longer than many had hoped.

This new development leaves the market mildly bullish, but cautiously so. It lowers the risk of policy shocks and supports steady economic growth, which is good for markets. But it does not open the door to easy money or rapid rallies. For now, investors seem content with stability, betting that slow, controlled cooling is better than the chaos of inflation flaring up again.